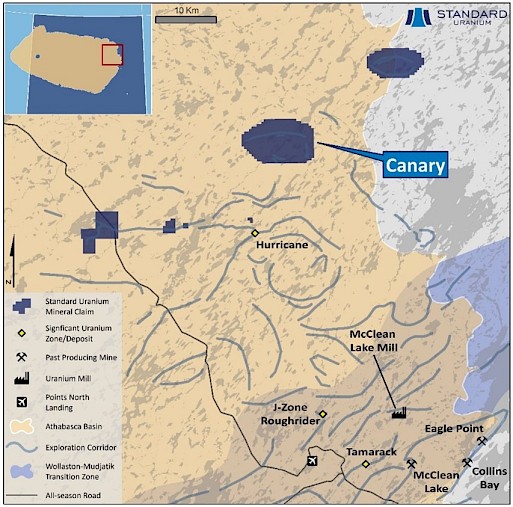

Vancouver, British Columbia, October 31, 2023 — Standard Uranium Ltd. (“Standard Uranium” or the “Company”) (TSX-V: STND) (OTCQB: STTDF) (Frankfurt: FWB:9SU) is pleased to announce that it has signed a term sheet (the “Term Sheet”), dated October 30, 2023, with Allora Resources Pty. Ltd. (the “Optionee”), an arms-length private company. Pursuant to the Term Sheet, the Optionee will be granted the option (the “Option”) to acquire up to a one-hundred percent interest in the 7,302-hectare Canary Project located in the Athabasca Basin (Figure 1).

Jon Bey, CEO and Chairman, commented, “Quickly reaching terms on our Canary project demonstrates the continued strong interest in our portfolio of projects fitting into our project generator model. We are currently in advanced discussions on 6 of our 7 projects and have the goal of completing up to 5 project deals in 2024, which could total more than $40M and commit $10M towards exploration programs next year.”

Figure 1. Overview of the eastern Athabasca Basin, highlighting Standard Uranium’s Canary project.

The Option is exercisable by the Optionee in three stages and is contingent on the Optionee completing a going public transaction on the Australian Securities Exchange (ASX). During the first stage, the Optionee can earn a fifty-percent interest in the Canary Project by completing cash payments totaling $200,000, arranging for the issuance of $200,000 worth of shares to the Company, and incurring $3,000,000 of expenditures, all within the first two years of the Option.

After earning a fifty-percent interest in the Canary Project, the second stage will commence. During the second stage, the Optionee can increase their interest in the Canary Project to seventy-five percent by completing a further cash payment of $100,000, arranging for the issuance of a further $100,000 worth of shares, and incurring an additional $3,000,000 of expenditures, all within the third year of the Option. Following completion of the second stage, the Optionee can acquire the remaining interest in the Canary Project by completing a bankable feasibility study and completing a payment to the Company equivalent to the value of the remaining interest as determined by an independent third-party.

In the event the Optionee acquires less than a one-hundred percent interest in the Canary Project, the parties intend to form a joint venture for the further development of the Project. During the first two stages of the Option, the Company will act as the operator of the Canary Project and will be entitled to charge a ten percent operator fee on expenditures. Following exercise of the Option, the Company will retain a one-and-one-half percent net smelter returns royalty on the Canary Project, of which one-half percent may be purchased back at any time for a one-time cash payment to the Company of $500,000.

The Term Sheet is non-binding at this time and the grant of the Option remains subject to the satisfactory completion of due diligence by the Optionee along with the negotiation of definitive documentation. No finders’ fee is payable by the Company in connection with the Option.

The scientific and technical information contained in this news release has been reviewed, verified, and approved by Sean Hillacre, P.Geo., President and VP Exploration of the Company and a “qualified person” as defined in NI 43-101.

About Standard Uranium (TSX-V: STND)

We find the fuel to power a clean energy future

Standard Uranium is a uranium exploration company and emerging project generator poised for discovery in the world’s richest uranium district. The Company holds interest in over 187,542 acres (75,895 hectares) in the world-class Athabasca Basin in Saskatchewan, Canada. Since its establishment, Standard Uranium has focused on the identification, acquisition, and exploration of Athabasca-style uranium targets with a view to discovery and future development.

Standard Uranium’s Atlantic, Canary, Ascent, Corvo, and Rocas Projects, in the eastern Athabasca Basin, comprise twenty-three mineral claims over 25,242 hectares. The eastern basin projects are highly prospective for unconformity related and/or basement hosted uranium deposits based on historical uranium occurrences, recently identified geophysical anomalies, and location along trend from several high-grade uranium discoveries.

Standard Uranium's Sun Dog project, in the northwest part of the Athabasca Basin, Saskatchewan, is comprised of nine mineral claims over 19,603 hectares. The Sun Dog project is highly prospective for basement and unconformity hosted uranium deposits yet remains largely untested by sufficient drilling despite its location proximal to uranium discoveries in the area.

Standard Uranium’s Davidson River Project, in the southwest part of the Athabasca Basin, Saskatchewan, comprises ten mineral claims over 30,737 hectares. Davidson River is highly prospective for basement-hosted uranium deposits due to its location along trend from recent high-grade uranium discoveries. However, owing to the large project size with multiple targets, it remains broadly under-tested by drilling. Recent intersections of wide, structurally deformed and strongly altered shear zones provide significant confidence in the exploration model and future success is expected.

For further information contact:

Jon Bey, Chief Executive Officer, and Chairman

1030 West Georgia Street, Suite 907

Vancouver, BC V6E 2Y3

Tel:1 (306) 850-6699

E-Mail: info@standarduranium.ca

Cautionary Statement Regarding Forward-Looking Statements

This news release contains “forward-looking statements” or “forward-looking information” (collectively, “forward-looking statements”) within the meaning of applicable securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as of the date of this news release. Forward-looking statements include, but are not limited to, statements regarding: the timing and content of upcoming work programs; geological interpretations; timing of the Company’s exploration programs; and estimates of market conditions.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those expressed or implied by forward-looking statements contained herein. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Certain important factors that could cause actual results, performance or achievements to differ materially from those in the forward-looking statements are highlighted in the “Risks and Uncertainties” in the Company’s management discussion and analysis for the fiscal year ended April 30, 2022, dated August 26, 2022.

Forward-looking statements are based upon a number of estimates and assumptions that, while considered reasonable by the Company at this time, are inherently subject to significant business, economic and competitive uncertainties and contingencies that may cause the Company’s actual financial results, performance, or achievements to be materially different from those expressed or implied herein. Some of the material factors or assumptions used to develop forward-looking statements include, without limitation: the future price of uranium; anticipated costs and the Company’s ability to raise additional capital if and when necessary; volatility in the market price of the Company’s securities; future sales of the Company’s securities; the Company’s ability to carry on exploration and development activities; the success of exploration, development and operations activities; the timing and results of drilling programs; the discovery of mineral resources on the Company’s mineral properties; the costs of operating and exploration expenditures; the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); uncertainties related to title to mineral properties; assessments by taxation authorities; fluctuations in general macroeconomic conditions.

The forward-looking statements contained in this news release are expressly qualified by this cautionary statement. Any forward-looking statements and the assumptions made with respect thereto are made as of the date of this news release and, accordingly, are subject to change after such date. The Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable securities laws. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.